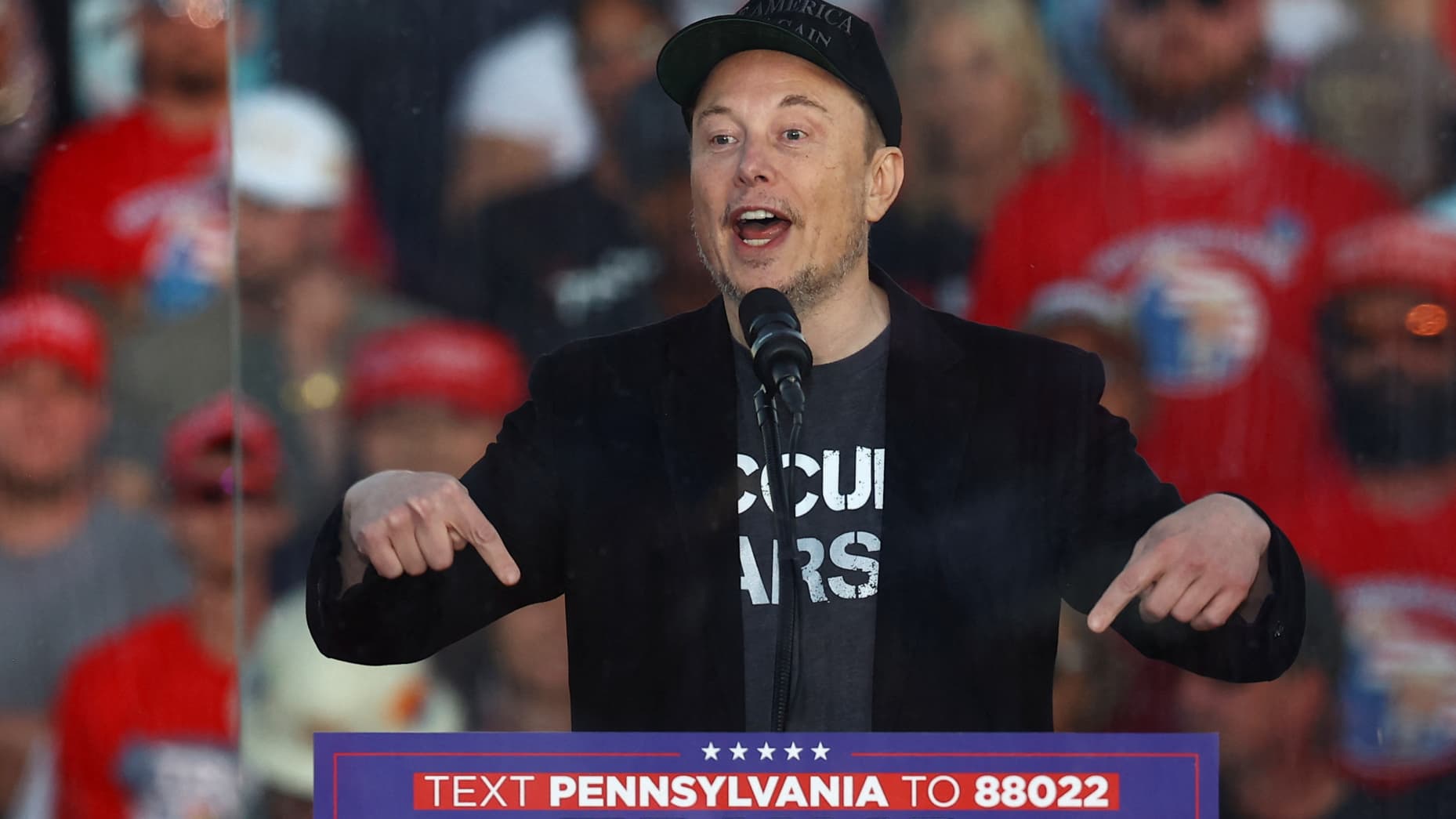

Elon Musk’s recent commentary on Donald Trump, alongside broader political developments, signals potential changes in U.S. policy that could impact markets. Musk’s push for deregulation, innovation-friendly policies, and economic expansion aligns with Trump’s historically business-centric governance approach. Understanding how this could influence key sectors provides insight for investors.

Musk has consistently advocated for minimal government interference in innovation. Policies from the Trump administration (2016–2020) focused on deregulation, tax reform, and domestic manufacturing, which directly benefited industries including:

- Electric Vehicles (EVs): Tax credits for EV purchases and reduced regulatory hurdles boosted Tesla’s production capacity during this period.

- Energy: Expansion of both renewable and fossil-fuel energy resources increased energy sector growth.

- Space and Defense: The establishment of the U.S. Space Force created opportunities for SpaceX and other private aerospace companies to secure government contracts.

If Trump’s policies were to return in 2025, Musk’s businesses, particularly Tesla and SpaceX, could see further advantages through relaxed manufacturing regulations, enhanced government funding for aerospace projects, and EV tax credit expansions.

Economic and Market Implications

Short-Term Market Volatility

Presidential elections traditionally introduce volatility into financial markets. Stocks in politically sensitive sectors, such as technology, energy, and defense, could experience significant short-term price swings. During the 2020 elections, the S&P 500 exhibited a ~5% fluctuation in the month surrounding the results, creating opportunities for traders.

Sectoral Opportunities

- Renewable Energy: Policy continuity supporting EVs, solar power, and battery production would bolster companies like Tesla and alternative energy ETFs such as the iShares Global Clean Energy ETF (ICLN).

- Aerospace and Defense: A Musk-Trump alignment could lead to higher defense spending, benefiting companies like Northrop Grumman, Lockheed Martin, and SpaceX contractors.

- Technology: Policies promoting domestic manufacturing would boost semiconductor companies like NVIDIA and TSMC, essential for AI and EV components.

Long-Term Economic Growth

Trump’s tax reforms in 2017 reduced corporate tax rates from 35% to 21%, spurring business investment. If such reforms are renewed, coupled with Musk’s advocacy for streamlined regulatory frameworks, sectors like tech and green energy could see prolonged growth. The U.S. GDP grew 2.9% in 2018 following these reforms, showcasing their stimulative potential.

Investment Strategies for 2024–2025

Short-Term Strategies

- Volatility Trades: Use ETFs tracking the S&P 500’s VIX index to hedge against election-driven volatility.

- Sector-Specific Focus: Position in high-volatility sectors like energy and tech. For instance, the ARK Innovation ETF (ARKK) offers exposure to disruptive technologies that could benefit from Musk-endorsed policies.

Medium to Long-Term Strategies

- Clean Energy and EV Growth: Invest in diversified renewable energy ETFs or companies leading the EV revolution. Tesla remains a leader, while European competitors like Volkswagen and battery suppliers like Albemarle could also thrive.

- Defense and Aerospace: Aerospace ETFs, such as SPDR S&P Aerospace & Defense ETF (XAR), provide exposure to companies well-positioned for increased defense spending.

Broader Takeaways

Elon Musk’s growing political influence and his strategic alignment with Trump’s policies highlight how corporate and government priorities intertwine. For investors, these shifts signal substantial opportunities in EVs, energy, and aerospace sectors. Maintaining a diversified portfolio, leveraging sectoral ETFs, and anticipating election-induced volatility could help maximize returns while mitigating risk.

As the political and economic landscapes evolve, keeping an eye on policy developments and aligning investments with potential beneficiaries will be crucial in 2025 and beyond.