Earnings season has kicked off, meaning publicly-traded companies will publish their second quarter 2022 results.

Usually earnings drive market sentiment as financial analysts project in advance the earnings that a specific campany could achieve, and if results are better than expected (aka beat estimates) the specific company has experience a higher growth and therefore stock price should see an increase; viceversa, if the specific company underperforms analysts’ earnings estimates, that means the company performed worst than expected, thus should see a fall in its stock price.

This earnings season analysts estimates for the S&P500 companies an overall growth rate of 4.3%, representing the lowest earning growth rate since the last quarter of 2020 for the S&P500 index.

We all know how financial markets and the general economy has been performing for the first half of 2022, so this slow down in earnings should not be of surprise. But how this will affect a stock portoflio and which path should be undertaken to mitigate losses in our portfolio and actually generate profits from such adverse market environment?

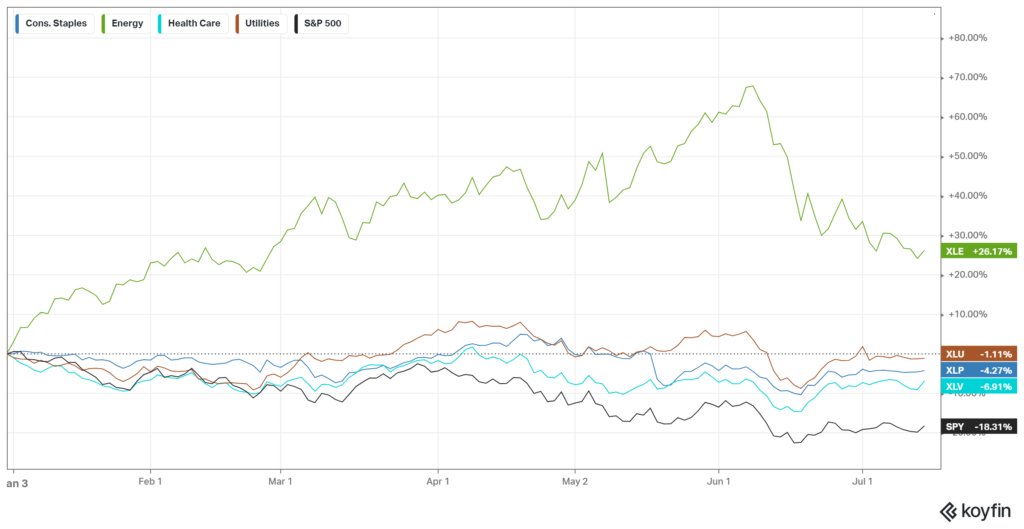

So far in 2022 the best performing companies were energy companies, which also pay dividends regularly. Although in the recent weeks the steam has been reducing for such sector experience a fall in stock prices as momentum is fading, energy companies will still have in their belly positive financial results from previous months that will be displayed in the coming earnings announcements. Thus an opportunity could be buy single stocks or ETFs of energy equities and benefiting from the potential stock price increases during earnings season.

In addition, an equity portfolio should be addressed toward utilities, consumer staples and health care sector, since such sector are the most resiliante when the economic cycle reaches its end, inflation does not seem to decelerate, FED and other central banks step in heavily, and in general considering all of this there are signs of a recession on the horizon.