In the past months financial markets have dropped from record high levels mainly due to rising inflation, hiking interest rates from Central Banks, and the possibility of a recession ahead which determined a negative sentiment in investors. This scenario altogether has caused an outflow of funds from equities, as investors were moving toward less risky assets classes.

However, markets have been rallying in the recent weeks getting a big boost from July’s Consumer Price Index (CPI) report that showed lower than expected inflation, passing on a positive effect on stocks and bonds, as well as on crypto, thus signaling that investors are cautiously bullish. According to Reuters, investors purchased US equity funds worth USD 6.85 billion, but European and Asian funds experienced outflows of USD 3.53 billion and USD 0.23 billion respectively. Among sector funds, tech, financials, and consumer staples saw inflows for USD 1.29 billion, USD 0.93 billion and USD 0.50 billion respectively.

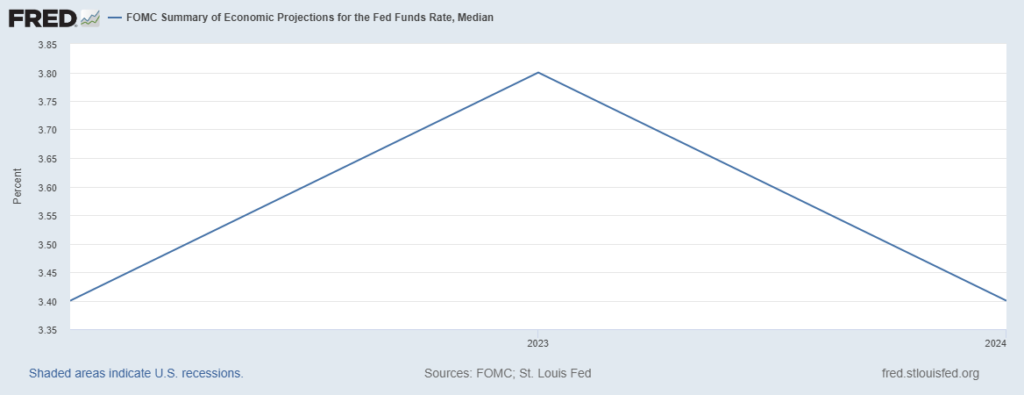

Such bullish expectations have led to a weaker dollar. Although a weak global economy benefits the dollar because is the world’s reserve currency, a weaker dollar will put upward pressures on US imports and could increase the price of commodities; this could benefit stock markets but damage the overall economy because a weaker dollar means rising prices, which in turn means rising inflation, vanishing the FED’s effort to reduce inflation through monetary tightening policies put in place lately. In fact, with inflation slightly declining, gas prices dropping and improving consumer sentiment, investors are setting expectations that the FED will cut interest rates next year to bolster the economy, thus benefiting stock prices.

Additionally, Q2 earnings pleased the market as companies look like they are managing inflationary pressures very well and demand doesn’t show signs of dramatics tailing off. Important will be to understand if earnings will hold well enough to keep markets at these levels and even send it higher. There is, although, the incumbent worry that hikes in interest rates are going to curb consumptions by consumers and settle in the real economy, thus affecting negatively future earnings.

Investors are now awaiting this week’s Jackson Hole meeting in hope to get more clarity from FED’s Chairman Powell on what to expect ahead. It is unclear what signal will Powell give but investors are eager to get any signal; indeed, investors will be hanging on each word and what is the tone, in order to get a clearer understanding.

Given all the above, now it is a very difficult time to identify the right stocks to buy. In July we have seen inflation data coming in lower than expected, which brought some sort of short-term relief to markets after the monetary tightening put in place by the FED and other Central Banks around the world, but the rising cost of living has pushed households to trading down toward more essential goods, cutting discretionary spending simply because consumers cannot afford discretionary purchases under such pressures.

This is a time where investors need to make sure they have a very well diversified portfolio and no single major big positions, because what’s ahead is such an uncertain outlook, and they need to look across different asset classes as well to trying give their portfolio that extra balance needed for facing the current situation.