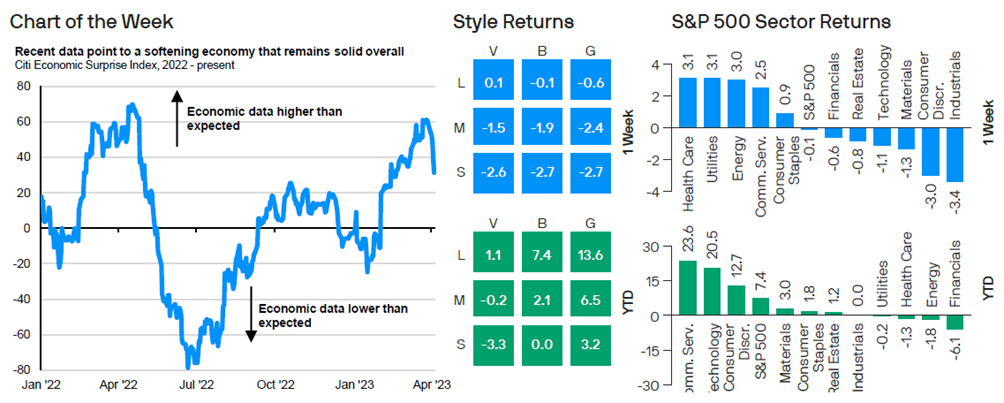

The U.S. economy started 2023 strongly, with many analysts tracking positive real GDP growth for 1Q23. Heading into the second quarter of 2023, the strength in the market this year so far has been notable. The S&P500 is up about 6.5%, while the investment-grade bond market is up 4.5%. Even so, recent gains in stocks were largely driven by valuation expansion, as price-to-earnings ratios climbed higher. Meanwhile, earnings-growth expectations during this period have moved lower. Analyst forecasts now indicate that S&P500 earnings growth will be less than 1.0% year-over-year, compared with a 5.0% estimate at the beginning of the year.

However, since late March, the economic data have disappointed and are pointing toward waning momentum in the U.S. economy. As such, the Atlanta FED’s GDPNow model is currently forecasting 1Q23 GDP growth of 1.5% (SAAR), down from its peak estimate of 3.5% in March. The path forward in the near term may be challenging, especially as the economy weakens and potentially enters a mild recession. This past week there have been signals of a pending slowdown emerging, including weakness in the labor market, manufacturing, and housing. And this comes as the banking sector looks to potentially tighten bank-lending standards, adding incremental downward pressure on consumers and corporations. Nonetheless, for long-term investors, there may be opportunities forming in the months ahead, particularly as markets start to look past the economic slowdown toward a recovery period.

Sources: J.P.Morgan Asset Management – Weekly Market Recap (10/04/2023)

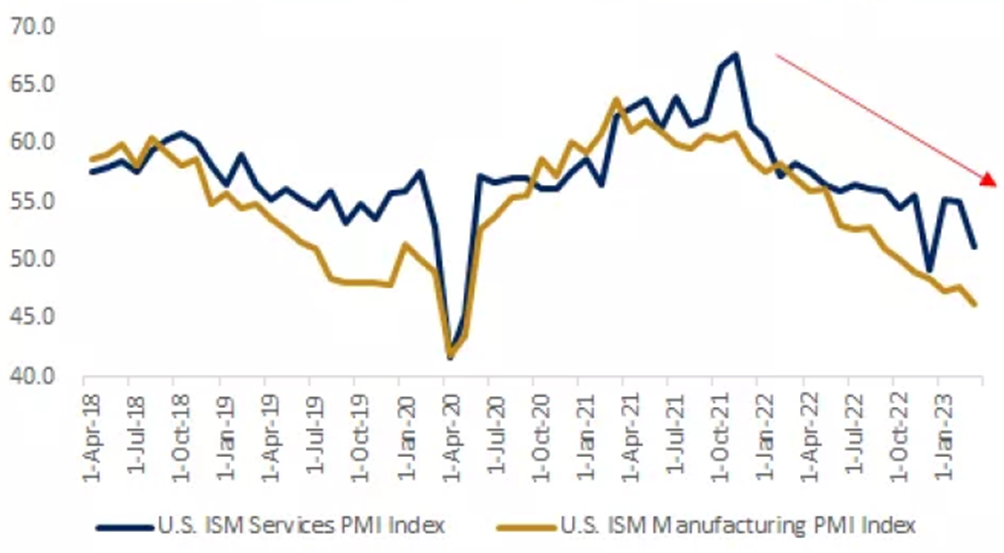

Last week, the March ISM manufacturing and services PMIs provided a timely read on the outlook for growth. The headline manufacturing reading declined to 46.3, the lowest reading since May 2020, due to decreases in new orders, inventories and employment. Meanwhile, the headline services PMI decreased to 51.2 but remained above the key level of 50, with new orders, business activity and prices seeing notable declines.

U.S. Manufacturing and Services Activity

Sources: FactSet; Edward Jones

Regarding the labor market, according to the February JOLTS report, job openings fell 6% to 9.9 million but remain well above the pre-pandemic trend. Furthermore, while total nonfarm quits did increase 3.8% month-over-month, we have seen a general downward trend in quits since they peaked in late 2021. Meanwhile, Friday’s employment report echoed a similar message. The unemployment rate decreased to 3.5% in March, well below the long-term average of 6.2%. However, total nonfarm employment only grew by 236.000, a notable deceleration from the prior month, and wage growth decelerated to 4.2% year-over-year.

Over the past weeks housing data came in softer than expected. The housing and rental components of inflation have remained elevated, although the real-time data indicate a housing market that has started to soften. Last week’s Case-Shiller national home price index saw moderating gains for seven straight months, coming in at 3.8% year-over-year, which has not been seen since the pre-pandemic period. Higher mortgage rates and cooling housing demand have weighed on the sector, which could also see further downside if mortgage-lending standards tighten.

Home prices and mortgage rates

Sources: FactSet; Edward Jones

Looking ahead

the question will be whether the FED interprets these data points as meaningful evidence of economy cooling as they fight to bring inflation back down to 2%. That determination will dictate the forward path of monetary policy, which at a minimum could stay tighter for longer than the market expects.

The most likely scenario remains for a mild recession perhaps starting in mid-2023. The recent set of economic data seems to be confirming this view, and a softening labor market is often one of the later shoes to drop. For investors, equity markets will likely not ignore an economic slowdown, and near-term risks to the recent rally remain elevated. But we also believe that markets have captured some of the recession in the bear market over the past 15 months.

To conclude, there is good news for balanced investors since the bond markets this year have performed well, as yields have come down more recently and as investors seek more safe haven assets. It is reasonable to expect bonds to continue to play this diversification role in the year ahead, particularly during periods of equity-market volatility.