Take-aways

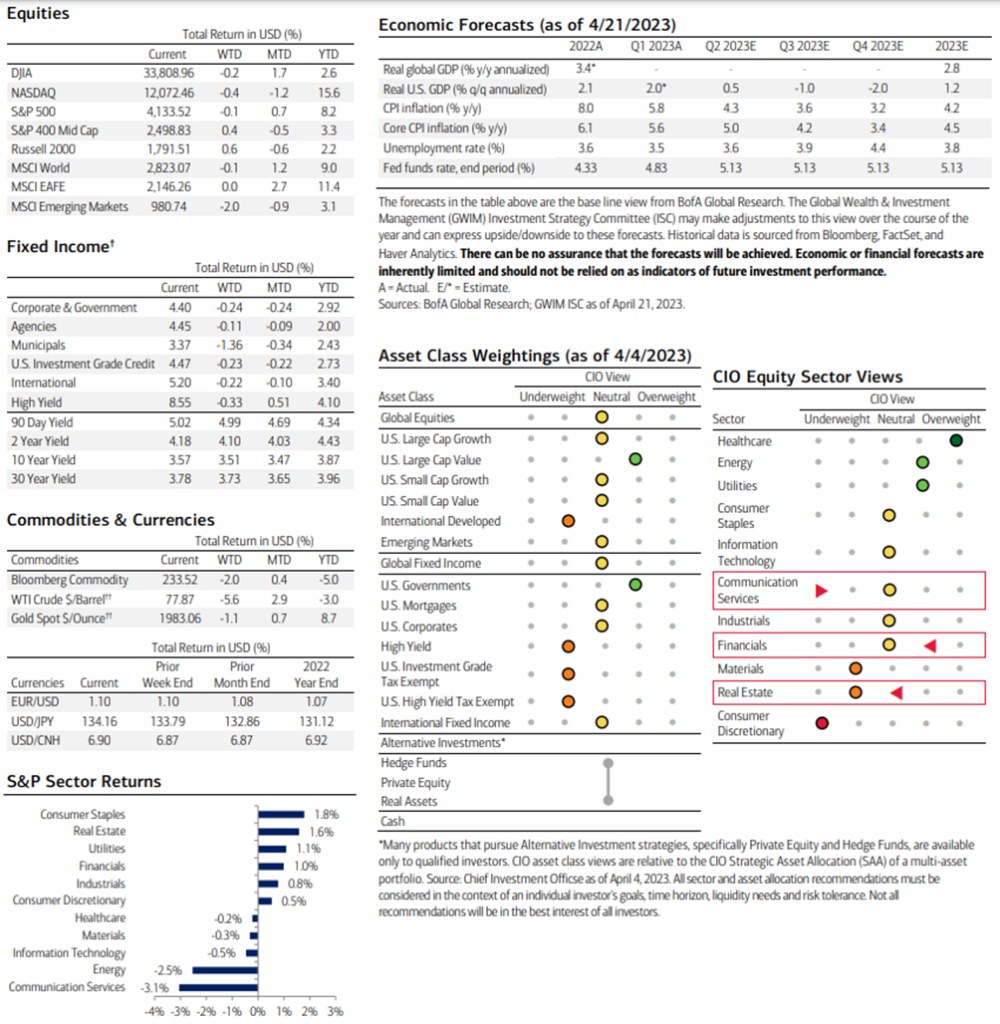

Amid the starting season of corporate earnings releases, in the recent months markets have been climbing the proverbial wall of worry. Both stocks and bonds have rebounded nicely, a trend of lower inflation has been established, and bond yields along with the U.S. dollar have peaked and moved lower.

Over the past several years, investors have seen non-U.S. Equities deliver many short bouts of moderate outperformance, only to see them unwound. And over the past six weeks since the onset of the banking sector problems in the U.S. and Europe, returns across international markets have again moderated, leaving space for opportunities in the international market landscape, but at this stage still favoring the U.S. on a tactical basis. In fact, economic indicators continue to support the view that U.S. growth is on a slowing trajectory as the FED’s aggressive liquidity tightening increasingly squeezes bank lending appetite, consumer spending, business expansion plans and corporate pricing power. Indeed, the data’s pattern of change over the past year has validated the predictive characteristics of time-honored leading indicators.

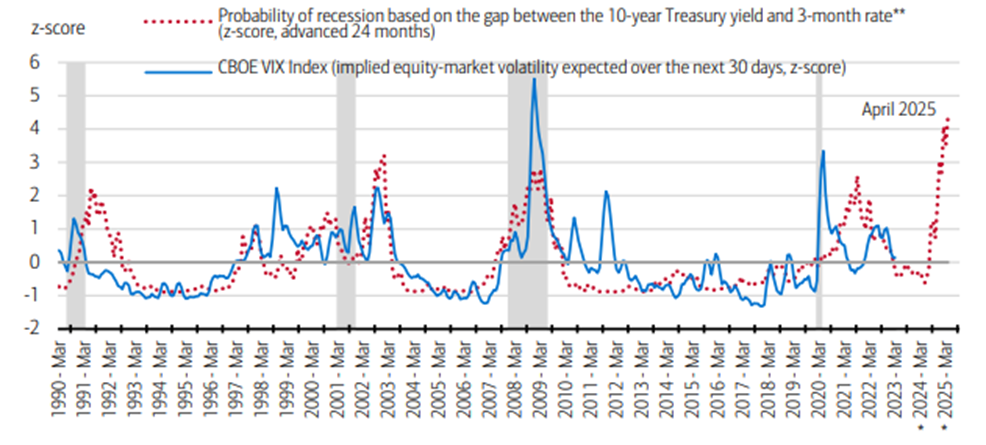

While this time may still be different, past experience with deeply inverted yield curves (i.e., much lower 10-year Treasury yields than short-term interest rates) strongly suggests that the weakest part of the current business cycle is likely to be felt starting later this year and in 2024. Even absent a recession, economic growth is generally seen remaining well below potential for at least two years, with risks to the downside.

Let’s take a deep overview on markets’ activity

Market activity has held up better than feared, and the economy remains in expansion. After adjusting for inflation, U.S. GDP grew 2.6% in the fourth quarter of 2022. And supported by a resilient consumer, estimates from the Atlanta FED point to a respectable 2.5% growth in the first quarter of this year.

The source of strength for the economy has been a robust job market, which is helping support personal incomes and spending. Unlike what happens during economic downturns, job gains have slowed but stayed positive, and the unemployment rate remains at historic lows, even with rising participation, as more workers have rejoined the labor force.

On the other side, some cracks have recently appeared, suggesting that the labor market is about to cool. Jobless claims remain low but have been rising over the past six months since bottoming in September 2022. Job openings have started to come down, layoff announcements have been trending up, and temporary-help payrolls are off their highs.

The leading economic index, which is composed of 10 different indicators that tend to move ahead of the economy, declined further in March to its lowest since November of 2020, signaling downside risks ahead.

Since the failure of Silicon Valley Bank, the stress in the banking sector has eased. But there are signs that credit conditions have continued to tighten, and that bank lending is slowing.

Despite the long list of investor worries that includes recession, inflation, debt-ceiling and geopolitical concerns, equity-market volatility has remained low. Also, the rise in corporate credit spreads has been contained, not indicating expectations for a spike in defaults, or broader signs of stress in the financial system.

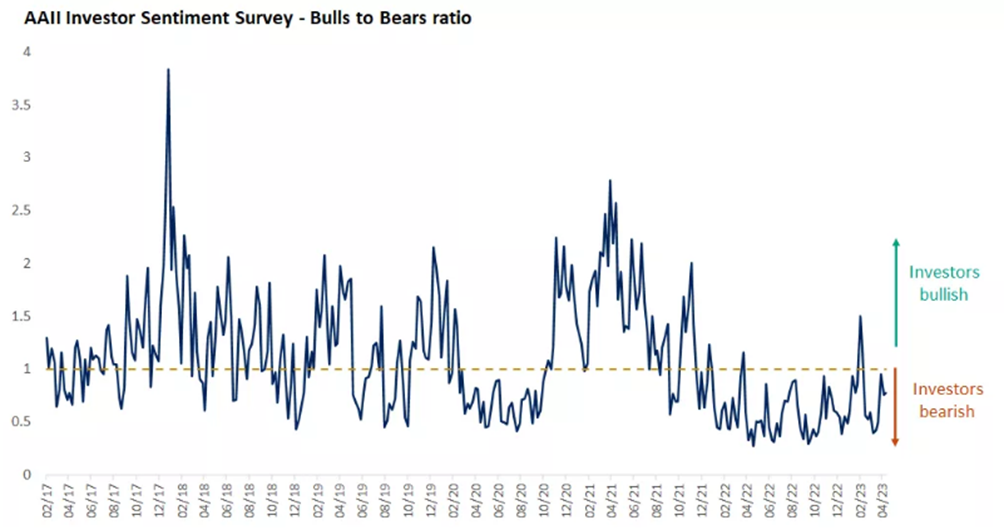

While sentiment has improved over the past six months, it remains bearish and cash is elevated. From a contrarian standpoint, depressed sentiment is supportive of equities, but not to the same extent as six months ago.

This year’s market rally has been relatively narrow, with a few mega-cap stocks driving the gains for major indexes. In each of the past six transitions from a bear to a bull market going back to 1980, small-cap stocks outperformed large-cap stocks six months off the low. This is not the case this time because, since October, the Russell 2000 has lagged the S&P 500 by 10%, rising 5.5% vs. 15.5% for the S&P. Markets seem navigating a more prolonged “U-shaped” recovery and are likely to remain volatile in the coming months, as economic and earnings data potentially underwhelm. Yet last year’s decline in valuations already reflected the potential for a mild recession, which markets won’t have to discount again this year if it emerges.

Sources: Edward Jones; Bloomber

Geographical markets overview

International markets came into 2023 on a strong footing after sharp declines in benchmark natural gas prices and the dismantling of zero-Covid restrictions provided respective tailwinds for Europe and China late last year. But over the full course of this year so far, non-U.S. Equity returns have been broadly in line with U.S. markets with wide disparities between individual regions. Developed Europe has led the rest of the world, supported by ongoing declines in the natural gas price. Latin America, emerging Europe and Japan have essentially matched U.S. and global aggregate indexes, with dollar weakness lifting common currency returns. And emerging Asia has lagged.

There’s been a lot to be cheerful about so far this year, from healthy Q1 U.S. gross domestic product (GDP) growth and signs of easing inflation to a quick resolution of the banking issue in March and chatter about a possible end to the Ukraine war. Add in China’s reopening and better-than-expected European performance, and the stealth S&P 500 Index recovery from about a 25% 2022 peak-to-trough drop makes sense. Reflecting still favorable current economic conditions and strong corporate cash flows, credit spreads have also remained benign, if no longer deep in the below-average territory typically associated with accommodative monetary policy. Given the usual lag of about two years between a surge in the probability of recession—as calculated by the FED of New York based on the yield-curve flattening and inversion of the past year—and a spike in expected equity market volatility, as measured by the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), it is not surprising to see volatility still fluctuating around average levels this year, either.

Sources: Merrill (Bank of America); Bloomberg; FactSet

In terms of relative importance, developed Europe still commands by far the largest share of the non-U.S. Equity universe at 32% for continental Europe alone and 42% including the U.K. market. Emerging Asia makes up the next largest share at 22% of non-U.S. market capitalization, with China alone accounting for 9% of the international total. Latin America and emerging Europe by contrast remain relatively inconsequential to the international picture overall at just 2% and 1% respectively.

It may seem an unusual time to favor Emerging Markets after major central banks’ rapid interest rate hikes. Yet there has been a clear resilience in Emerging Markets economic activity even as rising rates have slowed Developed Markets activity. Total returns for Emerging Markets debt have jumped above returns for Developed Markets credit since mid-2022 as a result. A key difference: Emerging Markets central banks kicked off rate hikes as much as a year before Developed Markets peers. Some already stopped hiking, while Developed Markets central banks have more to do and likely will not cut rates soon given stubborn inflation. Brazil’s central bank has held its policy rate at 13.75% since September. Central banks for India, South Korea and other nations have paused policy rates more recently. Rate cuts would help ramp up Emerging Markets economic growth sooner than in developed economies. The International Monetary Fund still sees Emerging Markets GDP growth about three times higher than for advanced economies this year and next, its April forecasts show. Emerging Markets central banks likely won’t need to keep up with Developed Markets central banks’ rate hikes to avoid currency depreciation. Emerging Markets currencies have, in fact, gained against the U.S. dollar as the Fed nears the end of its hiking cycle.

Higher-rated countries have falling inflation, more balanced external accounts, adequate currency reserves and lower debt-to-GDP levels. Yet Emerging Markets assets wouldn’t be immune to a risk asset selloff and U.S. dollar surge from more FED hikes. Our relative views flip on a horizon of five years and over. Geopolitical risks are weighing on Emerging Markets risk-adjusted returns, so we prefer Developed Markets equities in the long run. Developed Markets economies will likely benefit more from the transition to a lower-carbon world than Emerging Markets on that horizon.

Corporate profits

Given the stress in the banking system, all eyes were on the banks, which kicked off the earnings season on mid-April. Thus far, bank earnings have not shown significant strain, helping allay fears about deposit outflows and a big decline in net interest profit margins. As a result, since mid-April, the financial services sector has outperformed the broader market, though it remains the worst performer this year.

Revenue growth for the S&P 500 companies continues to be positive, supported by a still-growing economy and strength in services spending. For example, several airlines reported strong demand for travel, which continues to recover from the pandemic.

The U.S. dollar has declined about 10% since its peak six months ago, and this softening should benefit results of large multinational companies that derive revenue and sales from abroad.

There is a bit more downside risk to consensus estimates, but don’t expect a deep earnings contraction, as economic activity is likely to hold up better than prior downturns. Also important for investors is that, historically, valuations tend to bottom several months before earnings do. Therefore, October could still have marked the low for this bear market, even if earnings could fall more.

Inflation

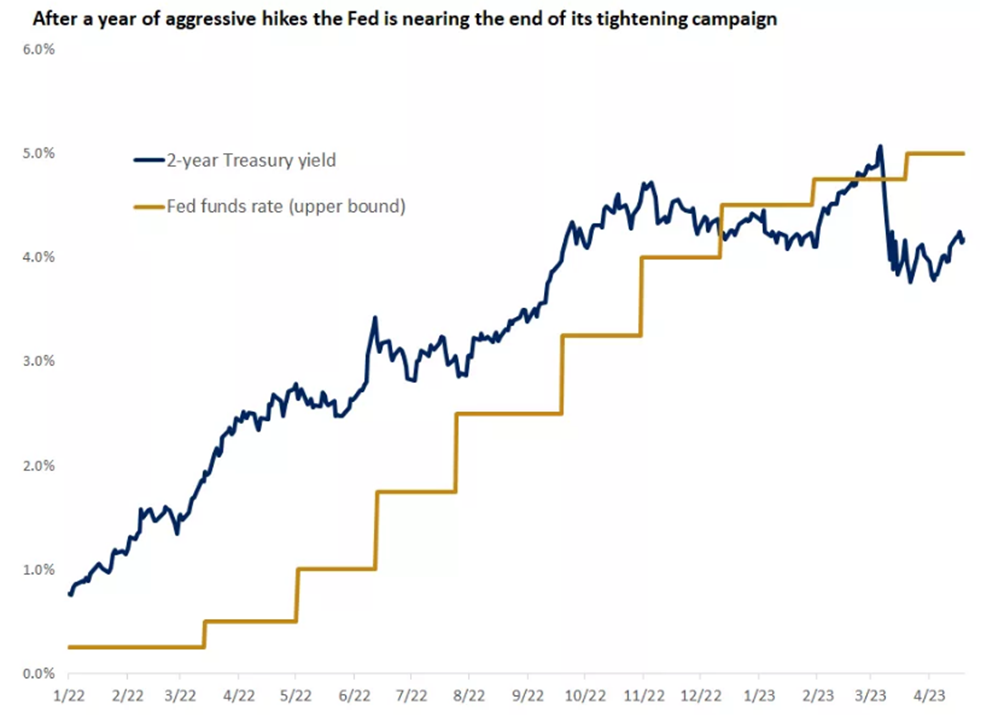

One year after the start of what proved to be the most aggressive rate hikes in 40 years, the FED is preparing to step to the sidelines. The stress in regional banks, the recent drop in 2-year Treasury yields below the fed funds rate, and the inverted yield curve are all signs that policy is turning overly restrictive. With the disinflation process underway and because of the long-reported lags before monetary policy tends to impact the economy, policymakers will likely follow a wait-and-see approach to rate hikes.

High inflation and aggressive FED tightening were the most forceful headwinds for the markets last year, as the sharp rise in interest rates pushed valuations lower. However, a turning point is likely to have been reached in both, supporting the rise in equities and bonds.

Sources: Edward Jones; Bloomberg

Conclusions and what’s ahead

A mild recession is more likely than not this year, as the delayed effects of FED tightening filter through the economy. While conditions will likely worsen ahead, we don’t foresee a deep or prolonged downturn, given the better starting point in consumer and corporate finances and our outlook for a modest rise in unemployment.

Expect the FED to pause rate hikes next month after the overnight policy rate reaches 5% – 5.25%, and then leave policy unchanged for the remainder of the year. This won’t be a cure-all, but it will be an important step towards a more sustainable recovery. With the end of tightening now in sight, it is reasonable to believe that the cyclical peak in long-term yields was made last year.

The rebound in stocks and bonds over the past six months has been supported by the turn in inflation, economic resilience, and peak in yields. To put it simply, there are good reasons why stocks are off their lows. Our view has been and continues to be that last year’s difficult investment environment set us up for better results this year. But there are conflicting signals, suggesting that markets might need some further fuel to continue to move higher.

With the likelihood of markets staying rangebound in the coming months before a new bull market emerges, with a renewed phase of volatility as an opportunity to position for a more sustainable rebound ahead.

Investors should stay close to their strategic, long-term allocation for most asset classes that make up a well-diversified portfolio. For now, there is an opening for an opportunity in Emerging Market equities driven by China’s reopening, offset by an underweight in the economically sensitive U.S. small-caps.

Market data recap

Sources: Merrill (Bank of America); Bloomberg; FactSet