If market expectations are met, the Federal Reserve is set to cut interest rates for the first time since the onset of the COVID-19 pandemic. While this move is widely anticipated, its effects will ripple through the markets for a while.

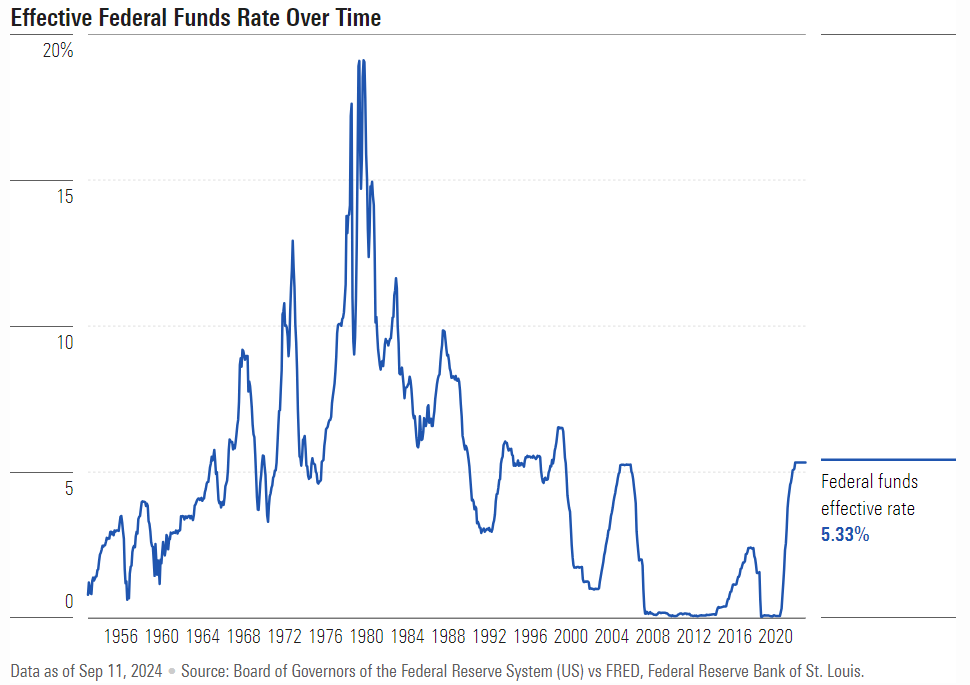

With inflation pressures easing from their 40-year highs, investors expect the central bank to lower the federal funds target rate by at least a quarter of a percentage point from the current 5.25%-5.50% range. Some are even speculating a more aggressive half-point cut, which would surpass the market’s predictions from just a few months ago. However, the greater uncertainty lies in how these cuts will impact investors.

How Do Stocks React to Rate Cuts?

Stocks are generally expected to perform well after rate cuts. The Federal Reserve typically lowers rates to stimulate the economy by making borrowing cheaper for businesses and consumers, which tends to be good news for equities. However, strategists caution investors to take a more nuanced view of the rate-cut cycle, especially in today’s unusual post-pandemic environment, dominated by high-growth tech stocks.

Historical data shows why drawing general conclusions can be tricky. In the four most recent rate-cut cycles, market performance varied significantly in the year following the start of a new easing phase. For example, the Morningstar US Market Index rose by over 21% in the 12 months after the Fed began cutting rates in 1995, when the economy experienced a “soft landing.” In contrast, when the Fed cut rates in 2001, following the dot-com bubble, market returns fell by over 10%.

The Fed’s Reason for Cutting Matters

The key difference in these outcomes lies in the market’s fundamentals and the Fed’s stance. Markets tend to react positively when the central bank is perceived as being in control and orchestrating a soft landing for the economy. On the other hand, if the rate cuts are seen as a response to an impending recession, the reaction may be far less favorable.

Looking ahead, it’s essential to understand why the Fed is cutting rates. If the central bank believes the economy is heading toward a downturn, this could spell trouble for investors. But if it’s merely recalibrating monetary policy without an economic threat, markets could remain resilient.

The Role of Earnings Growth

Interest rate changes don’t tell the whole story. Earnings growth is a more reliable indicator of future stock market performance. When earnings growth is positive and accelerating alongside falling rates, this typically bodes well for the markets. Historical analysis shows that under these conditions, the S&P 500 has posted an average return of 14%, compared to 11% when only rates drop and 7% when both earnings and rates decline.

The spread between the federal funds rate and inflation also plays a significant role. A larger gap between these two metrics suggests the Fed has more room to reduce rates, which generally benefits stocks. Currently, there is an unusually wide gap between the federal funds rate and inflation, providing some optimism for future market performance.

Preparing for Market Volatility

While data can be encouraging, market movements are ultimately driven by investor sentiment. As the Fed begins its rate-cutting cycle, investors will likely remain concerned about the broader economic picture. Despite recent market gains, uncertainties persist about whether the central bank has waited too long to reduce rates, raising the risk of a recession.

Although a significant portion of the market’s recent rally has already priced in the upcoming rate cuts, there’s still potential for further gains if the economy manages a soft landing. However, it’s unlikely this will become immediately apparent, and experts predict volatility in the coming months.

How Investors Can Prepare

To navigate this uncertain environment, investors should consider positioning themselves for both possible outcomes. While a soft landing remains the base case for many analysts, the recent slowdown in labor market data raises concerns. Defensive stocks and real estate investment trusts (REITs), which tend to benefit from lower rates, may offer protection in the event of a significant economic downturn.

Rate-sensitive sectors, such as financials and real estate, could also present opportunities, as these industries have not fully priced in the impact of Fed cuts. Small-cap stocks, which have struggled in recent years, may outperform if the economy stays strong, though they may come with increased volatility.

Ultimately, market valuations also favor investors, as large-cap tech stocks have become increasingly expensive this year. This opens up potential opportunities in less popular sectors, should the economy weather the storm of rate cuts successfully.