Picture: credits Euronews.com

Preparing for the 2024 U.S. Election

Every four years, the U.S. presidential election cycle brings a mix of anticipation and uncertainty for investors. With the next election on the horizon, markets are once again preparing for potential shifts in policy, regulation, and economic direction. The U.S. presidential election can have wide-reaching impacts on the American and global economy, influencing everything from stock prices and interest rates to global trade and investor confidence. In this guide, we’ll explore how elections impact the financial markets, the mechanisms behind these changes, and strategies investors can consider in an election year.

While every election cycle is unique, patterns suggest that election years bring both risks and opportunities for investors. By diversifying across sectors, focusing on defensive stocks, and considering safe-haven assets, investors can better navigate the volatility that often accompanies political transitions. Remember, the best approach is often to stay the course, avoid impulsive decisions, and focus on long-term goals.

In an election year, uncertainty is inevitable—but with a clear strategy, investors can position themselves to benefit from the changes ahead.

How Do Presidential Elections Affect Financial Markets?

The link between presidential elections and market performance is not always straightforward, but historical data suggests several patterns:

- Increased Volatility: The period leading up to an election often brings heightened volatility. As uncertainty about future policies and potential regulations increases, investors may react with caution or make quick portfolio adjustments.

- Market Behavior by Party: Markets tend to respond differently to Republican and Democratic candidates. Generally, Republicans are associated with business-friendly policies, favoring tax cuts and deregulation, while Democrats often focus on increased regulation, healthcare, and social spending. However, these are broad trends, and individual candidates often bring unique proposals that can alter market perceptions.

- Sector-Specific Movements: Policies emphasized by each party can lead to sector-specific changes. For example:

- Technology: Democrats may push for stricter tech regulation, which could pressure tech stocks.

- Healthcare and Pharma: Democrats often advocate for healthcare reform, which may affect healthcare stocks. Conversely, Republicans generally support market-driven healthcare solutions, which may favor private healthcare providers.

- Energy: Republicans tend to favor traditional energy sources like oil and gas, while Democrats prioritize clean energy and environmental regulations, which can benefit renewable energy stocks.

- Currency Fluctuations and Trade: The election can also affect the value of the U.S. dollar, particularly if a candidate’s policies are expected to change the nation’s stance on international trade. A strong dollar generally indicates confidence in U.S. policy direction, while trade restrictions and tariffs can introduce currency fluctuations.

Election Year Market Trends and Patterns

Historical data from past U.S. elections reveal several patterns. Here’s a look at some of the most significant trends:

- Election Year Gains: The U.S. stock market has a track record of performing positively in election years. According to historical data from the S&P 500, markets have closed higher in roughly 80% of election years since 1928. This trend is often attributed to consumer and investor optimism about future growth, regardless of which party wins.

- Pre-Election Uncertainty and Post-Election Rebound: As the election date approaches, markets often see increased volatility, particularly if the race is tight. However, once a winner is declared, markets tend to stabilize, even if only temporarily, as uncertainty is replaced with more concrete policy expectations.

- First-Year Presidential Effects: The first year following an election can be challenging for markets as new policies are introduced. Depending on the administration’s approach, these policies can influence inflation, interest rates, and government spending, impacting economic sectors differently.

Mechanism of Impact: Why Do Elections Affect Markets?

Understanding why elections impact markets requires examining investor behavior and economic policy mechanisms:

- Policy Uncertainty: Elections introduce uncertainty about future economic policies, affecting investor sentiment. When investors are unsure about tax policies, spending priorities, or regulatory changes, they may hesitate to make long-term investments, resulting in reduced market liquidity.

- Interest Rates and Fiscal Policies: Presidential candidates often bring specific fiscal policies (like infrastructure spending or social programs) that could affect interest rates. For example, a policy focused on large government spending might result in inflationary pressures, prompting central banks to adjust interest rates to manage inflation.

- International Relations and Trade: The president has significant influence over foreign policy, which can directly impact trade and multinational corporations. Any shift in trade policy, such as tariffs or trade agreements, can create ripple effects across global markets.

- Sector-Specific Policies: Different administrations focus on different sectors, as mentioned earlier. For example, Republicans may favor deregulation in finance and energy, potentially benefiting these sectors, while Democrats may push for renewable energy subsidies and healthcare reform, influencing investor behavior in those sectors.

Investment Strategies During Election Cycles

While it’s impossible to predict the future with certainty, there are strategies that investors can consider to navigate the volatility and potential opportunities presented by an election year.

1. Diversify Across Sectors

- Diversification remains one of the most effective strategies for managing election-year risk. Investing across various sectors helps mitigate the impact of sector-specific policy changes. For example, a portfolio containing a mix of technology, healthcare, energy, and industrial stocks is less vulnerable to shifts in any single sector.

2. Focus on Defensive Stocks

- In times of uncertainty, defensive stocks—those of companies in essential industries like utilities, healthcare, and consumer staples—often perform well. These industries typically remain stable regardless of political changes, as demand for essential goods and services remains constant.

3. Consider International Diversification

- Since U.S. elections can introduce volatility to domestic markets, some investors turn to international investments for balance. Exposure to non-U.S. markets can reduce the impact of U.S.-specific policies on a portfolio, providing stability.

4. Invest in Safe-Haven Assets

- In uncertain times, safe-haven assets like gold, bonds, and even cash may protect against market downturns. For instance, Treasury bonds are generally seen as low-risk, and precious metals like gold often gain value as investors seek stability during turbulent periods.

5. Utilize ETFs for Sector-Based Plays

- Sector-specific ETFs allow investors to align with sectors likely to benefit from either party’s anticipated policies. For example:

- Renewable Energy ETFs (for Democratic wins focusing on environmental initiatives)

- Healthcare ETFs (to hedge against policy shifts in healthcare regulation)

- Financial and Industrial ETFs (often favored during Republican administrations advocating for business-friendly policies)

Hypothetical Scenario: How Different Outcomes Might Affect Key Sectors

Let’s look at a hypothetical outcome based on party platforms, assuming historical tendencies hold:

| Sector | Republican Win | Democratic Win |

|---|---|---|

| Energy | Fossil fuels, oil, gas benefit | Renewable energy gains |

| Healthcare | Market-based approach, lower regs | Potential reform, increased costs |

| Tech | Fewer antitrust issues | Stricter regulations |

| Infrastructure | Privatized projects | Federal spending initiatives |

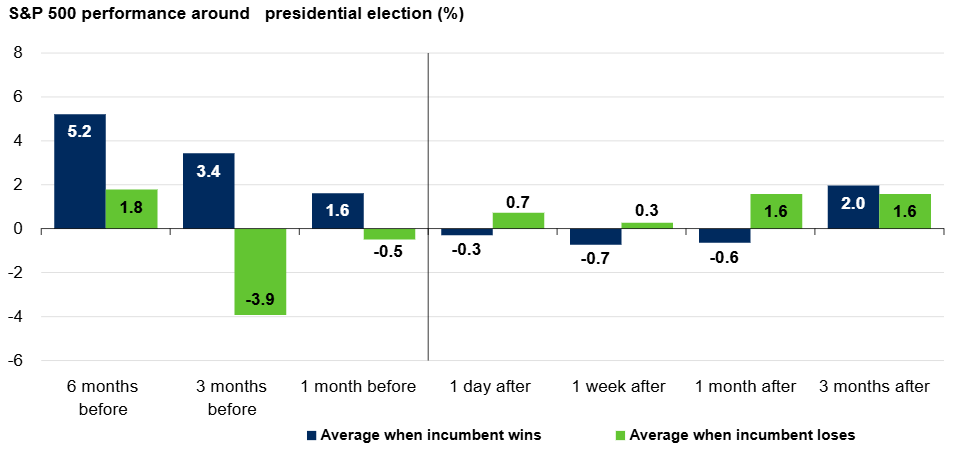

Visualizing Market Reaction: Historical S&P 500 Performance in Election Years

Below is a sample graph showing S&P 500 performance during previous election years. This data provides insights into how markets have historically responded to election outcomes, particularly showing trends in pre-election volatility and post-election stability.

Source: Schroders Economics Group, LSEG Datastream. 1 March 2024