With recent mortgage rates climbing to highs not seen in over a decade, many potential homeowners and real estate investors are anxiously awaiting signs of a decline. So, when might mortgage rates finally ease? The answer lies in a mix of Federal Reserve actions, inflation trends, and broader economic indicators.

Why Have Mortgage Rates Increased So Drastically?

Rates are impacted primarily by inflation and the Federal Reserve’s monetary policy. In response to inflation pressures, the Fed has implemented a series of interest rate hikes over recent quarters. When the Fed raises its federal funds rate, it indirectly pushes up borrowing costs across the board, including for mortgages. Higher mortgage rates help cool demand, balancing economic growth with inflation control.

Key Drivers Behind Mortgage Rate Movements

To predict when mortgage rates might decline, it’s essential to understand the primary drivers:

- Federal Reserve Decisions: The Fed’s actions, such as adjusting its rate-hiking policy, will have direct implications for mortgage rates. If inflation begins to recede, the Fed may slow or halt rate hikes, creating a favorable environment for mortgage rates to drop.

- Inflation Data: The pace at which inflation cools will determine the Fed’s future policies. High inflation often results in continued rate increases, while sustained declines in inflation could lead to more lenient monetary policy.

- Market Expectations and Economic Growth: Mortgage rates also respond to investor expectations. If investors anticipate lower inflation or a recession, they may shift to safer investments like bonds, pushing bond prices up and yields down, which can lower mortgage rates as a result.

When Might Rates Start to Drop?

Predicting a timeline for rate decreases is challenging, but some factors may signal a turning point:

- Inflation Declines: A consistent downward trend in inflation would ease the Fed’s pressure to continue raising rates. If inflation remains elevated, rate cuts will be delayed, but significant declines could create conditions for lower mortgage rates.

- Federal Reserve Policy Shift: The Fed has indicated it’s watching data closely. If the economy shows signs of a slowdown or if inflationary pressures ease substantially, a reduction or pause in interest rate increases could come as soon as the upcoming quarters.

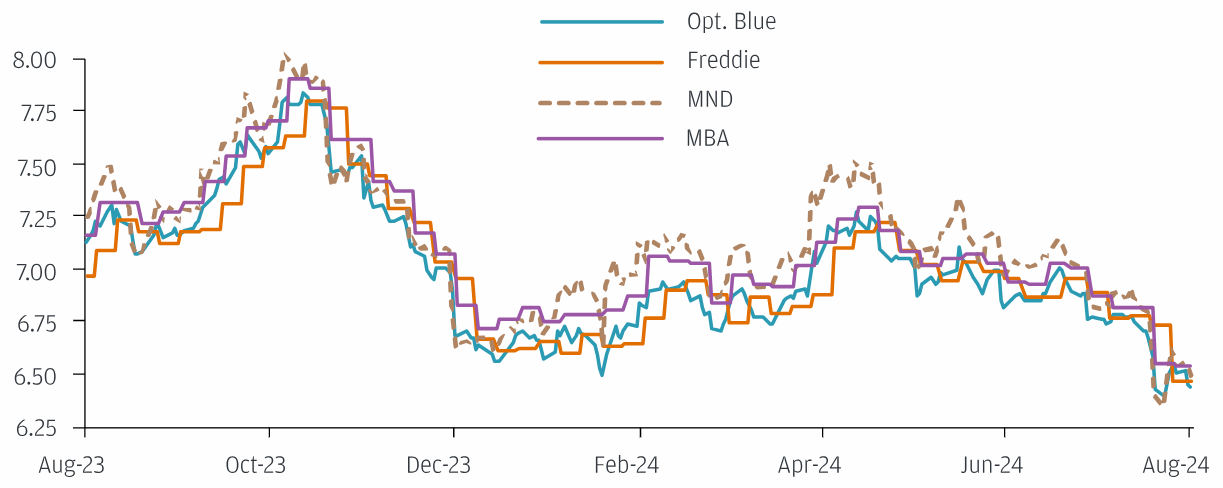

Trends of primary mortgage rates

Implications for Homebuyers and Investors

High mortgage rates don’t necessarily mean it’s a bad time to buy a home, but buyers and investors may want to consider alternative strategies:

- Locking Rates with Flexibility: Homebuyers could consider locking in current rates with lenders that offer flexible terms, allowing for future refinancing if rates decline.

- Adjustable-Rate Mortgages (ARMs): These loans start with a lower fixed interest rate that adjusts after an initial period. ARMs could offer lower payments upfront, but their adjustment periods mean they’re ideal only if rates are expected to fall or if refinancing soon is an option.

- Refinancing Opportunities: For homeowners with existing mortgages, watching the market for potential refinancing opportunities is key. If rates decline, refinancing could offer substantial savings over time.

Preparing for Rate Changes

Staying updated on economic indicators, Fed announcements, and inflation reports will provide homebuyers and investors with insights into potential rate shifts. While it’s difficult to predict exact timing, understanding the factors driving mortgage rates can guide smart, strategic decisions when considering property investments.