In the world of investing, the terms “bear market” and “bull market” are often used to describe major trends in financial markets. While these terms are frequently mentioned, the exact definitions can vary slightly depending on the source.

Defining Bull and Bear Markets

A bear market is generally defined as a period when an index or asset falls by 20% or more from its peak to its lowest point. This often signals a sustained downturn that brings uncertainty and fear among investors. On the other hand, a bull market refers to the stretch between bear markets, where an asset or index rises from a trough to a peak.

For example, on March 12, 2020, U.S. equities officially entered a bear market when the S&P 500 dropped over 20% from its all-time high in just 22 days. This marked the end of a bull market that began in March 2009, following the global financial crisis. Such rapid declines are unsettling, but they are part of a long-standing cycle that has repeated many times in financial history.

A Historical Perspective: We’ve Seen This Before

Despite the anxiety that often accompanies a bear market, it’s important to remember that market declines are not uncharted territory. U.S. equity markets have experienced 10 distinct bear markets in the last 70 years. This means that, on average, long-term investors can expect to face a bear market about once every 7 years.

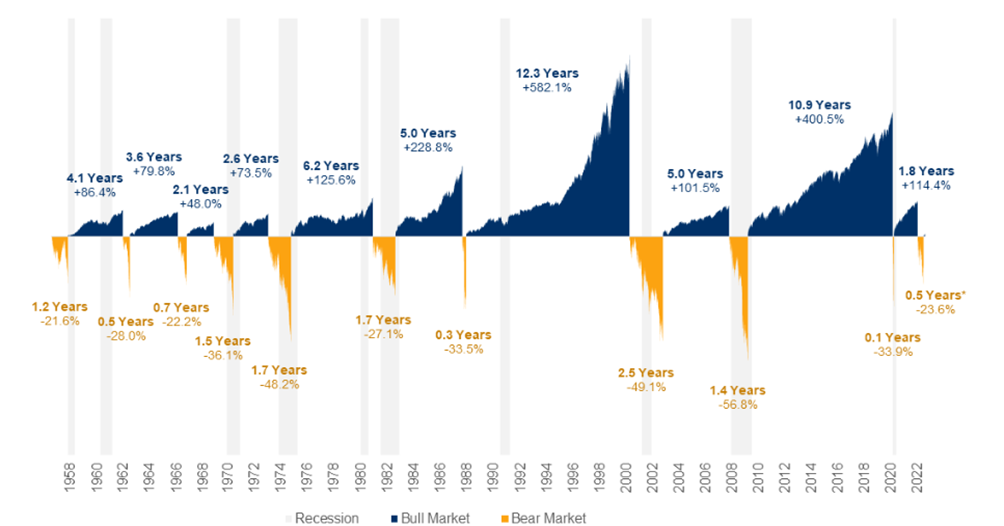

Chart 1: As of June 13, 2022. Reflects S&P 500 Index. Source: RBC GAM, Bloomberg.

This chart above shows the history of bear markets in U.S. equities since 1950. It highlights both the duration and severity of each downturn, reinforcing the fact that bear markets come in various forms. Some are short and mild, while others, like the 2008 global financial crisis, can be long and severe.

For example, in 1957, U.S. equities dropped by 20.7% and then began to recover after just three months. In contrast, during the financial crisis of 2008, the market fell by nearly 57% and didn’t recover for about 18 months. This variability shows that no two bear markets are the same, but markets have always recovered in the long term.

The Market’s Long-Term Resilience

A key takeaway from market history is that, regardless of the severity or duration of a bear market, financial markets have always bounced back, eventually reaching new highs. This long-term resilience is vital for investors to understand, as it underscores the importance of staying invested even during downturns.

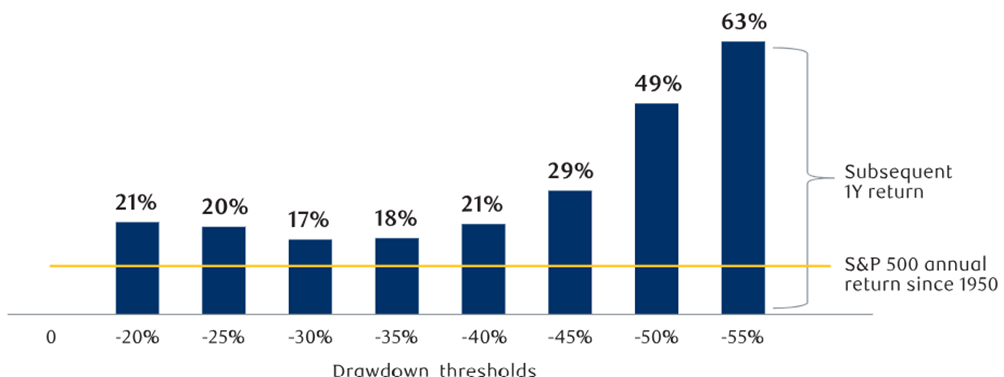

Chart 2: Source: RBC GAM, Bloomberg. S&P 500 TR (USD). Data reflects time period of January 1, 1950 to February 29, 2020. Subsequent 1-year return reflects the median 1-year return.

The chart above visualizes how U.S. equities have consistently rebounded after significant downturns. In the year following a major drop, the market’s recovery has often been significant. This pattern has repeated throughout history, reinforcing the idea that patience and a long-term view are essential during turbulent times.

The S&P 500: Comparing the Current Bull Market to Historical Patterns

The current bull market, which began after the 2020 bear market, can be compared to previous bull markets in terms of duration and performance. While every bull market differs, the underlying upward trajectory remains a constant, especially after bear markets.

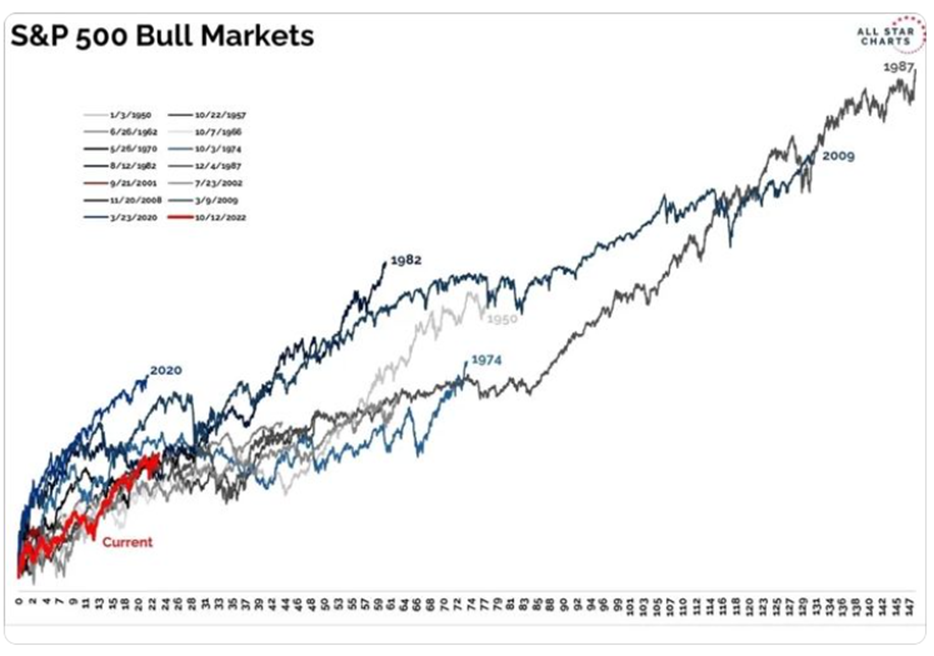

Chart 3: Source: J-C Parets, Grant Hawkridge.

This chart compares the current S&P 500 bull market to historical bull markets, providing perspective on how today’s market performs relative to previous cycles. As the data illustrates, bull markets are typically periods of growth and recovery, offering opportunities for long-term investors.

Sticking to a Financial Plan Amid Market Volatility

The emotional challenge of watching your investments fluctuate can be overwhelming, particularly during a bear market. However, making drastic changes to your portfolio during these times can hinder your long-term financial success. Historically, trying to “time the bottom” of a bear market is nearly impossible, and those who attempt to do so often miss out on the recovery.

Having a well-thought-out investment strategy is crucial. A solid plan allows you to balance the fear from negative headlines with the knowledge that lower prices can lead to higher long-term returns. In fact, bear markets may present opportunities to acquire quality investments at discounted prices.

By sticking to a disciplined investment approach, even in the face of volatility, you greatly improve your chances of achieving your financial goals. The chart showing market rebounds after bear markets further illustrates this point—those who stayed invested saw significant gains in the year following a downturn.

Embracing Market Cycles for Long-Term Success

Bull and bear markets are natural components of the investing cycle. By understanding their characteristics and maintaining a long-term perspective, investors can navigate through market ups and downs with greater confidence. Markets have proven resilient over time, and sticking to a financial plan during periods of volatility can help turn challenges into opportunities.

Patience, discipline, and an understanding of market cycles are essential traits for long-term investment success. While bear markets are unsettling, history shows they are often followed by periods of growth that reward those who stay the course.