Renewable energy is no longer just a topic for environmentalists and activists—it has become one of the fastest-growing sectors for investors seeking both financial returns and sustainability. As the world shifts towards reducing carbon emissions and combating climate change, clean energy investments are gaining prominence. For young investors looking to build a future-oriented portfolio, investing in renewable energy provides a unique opportunity to align their financial goals with global environmental efforts.

What is Renewable Energy?

Renewable energy comes from sources that are naturally replenished, such as solar, wind, hydro, and geothermal energy. Unlike fossil fuels (coal, oil, and natural gas), which are finite and contribute to global warming, renewable energy has a much smaller environmental footprint. This sector plays a crucial role in the global transition toward sustainability, which is why governments and corporations alike are heavily investing in it.

Why Should Young Investors Consider Renewable Energy?

There are several reasons why investing in renewable energy is an attractive proposition for young investors:

- Long-term growth potential: The renewable energy market is expected to continue growing for decades as countries aim for net-zero emissions. According to the International Energy Agency (IEA), renewable energy is projected to account for nearly 95% of the increase in global power capacity through 2026.

- Sustainability and social impact: Millennials and Gen Z are known for prioritizing environmental and social causes in their consumer and investment choices. Renewable energy offers a way to invest with purpose while potentially earning solid financial returns.

- Government incentives and subsidies: Many governments worldwide are providing tax breaks, subsidies, and financial incentives to companies in the renewable energy space. These policies help drive innovation and growth, creating opportunities for investors.

- Energy independence: As the world moves away from fossil fuels, renewable energy plays a key role in creating a more stable and independent energy market, reducing reliance on oil-importing nations.

Market Growth and Future Outlook

The renewable energy sector has experienced massive growth in recent years, driven by technological advancements and increasing awareness of climate change. Below are some key data points that highlight this growth:

- Renewable Energy Investment Growth: Global investment in renewable energy reached $500 billion in 2023, a record high. This represents a 10% increase from 2022, according to the Bloomberg New Energy Finance report.

- Solar and Wind Leading the Charge: Solar and wind energy are the two fastest-growing renewable energy sources. The International Renewable Energy Agency (IRENA) reported that solar capacity grew by 25% in 2023, while wind capacity grew by 17%. These two sectors accounted for 85% of all new renewable energy installations globally.

- Global Renewable Energy Capacity: By 2030, the global renewable energy capacity is expected to reach nearly 13,000 gigawatts (GW), more than double the capacity in 2020, according to the IEA World Energy Outlook report.

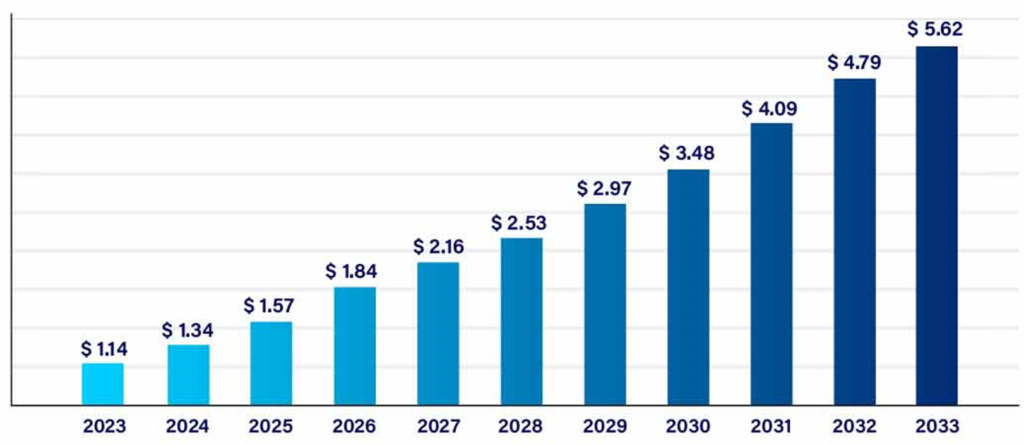

Accordind to a study conducted by Nova One Advisor, the size of the renewable energy market size in terms of US dollars is expcted to grow from $ 1.14 trillion in 2023 to a staggering $ 5.62 trillion by the end of 2033.

Sources: Nova One Advisor

How to Invest in Renewable Energy

For young investors interested in renewable energy, there are several ways to get involved:

- Stocks in Renewable Energy Companies: Some of the largest renewable energy companies globally include NextEra Energy, Vestas Wind Systems, Siemens Gamesa, and Enphase Energy. These companies are involved in wind, solar, and other clean energy technologies.

- Exchange-Traded Funds (ETFs): ETFs are a great way for beginner investors to diversify their portfolios without picking individual stocks. Some popular renewable energy ETFs include:

- iShares Global Clean Energy ETF (ICLN): Focuses on global companies involved in clean energy production.

- Invesco Solar ETF (TAN): Specializes in solar energy companies.

- First Trust Global Wind Energy ETF (FAN): Tracks companies focused on wind energy production and equipment manufacturing.

- Green Bonds: Green bonds are issued to fund projects that have positive environmental benefits, such as renewable energy projects. These can be a lower-risk way to invest in the sector while supporting sustainable initiatives.

- Renewable Energy REITs (Real Estate Investment Trusts): Some REITs focus on clean energy infrastructure, such as solar farms and wind turbine facilities. Investing in these can give you exposure to the real estate side of the renewable energy boom.

Risks to Consider

As with any investment, renewable energy comes with certain risks. Here are a few to keep in mind:

- Volatility: Like other sectors, renewable energy stocks and ETFs can be volatile. For example, the solar industry is particularly prone to price swings due to changes in government policies and subsidies.

- Regulatory Changes: Government support and incentives are crucial for the growth of the renewable energy sector. Changes in regulations, such as reduced subsidies or altered environmental policies, can impact the profitability of renewable energy companies.

- Technological Advances: The sector is still evolving, and new technologies could disrupt existing companies. Investors should be aware of innovations that could either propel or hinder specific businesses.

A Smart Choice for Future-Focused Investors

Investing in renewable energy is an excellent option for young investors who want to combine financial growth with environmental responsibility. With the world increasingly moving toward clean energy solutions, this sector offers both substantial long-term potential and the opportunity to contribute to a greener, more sustainable future.

By understanding the market, diversifying your investments, and keeping an eye on global trends and regulations, renewable energy can be a rewarding addition to your portfolio.