Investing in stocks can feel intimidating, especially for beginners, but the right investments can set you on the path to financial growth. The year 2025 is poised to be an exciting time in the markets, with technological advancements, global transitions toward sustainability, and continued post-pandemic recovery driving opportunities. Below, we dive into five compelling stocks to consider for your portfolio, so get ready for reshifting your portfolio as we approach the new year!

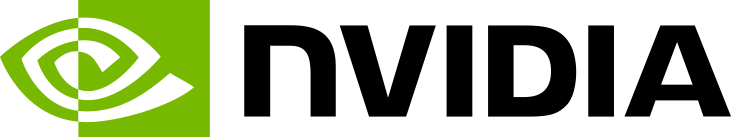

1. NVIDIA (NVDA): The AI Powerhouse

Why NVIDIA?

NVIDIA is a leader in designing GPUs (graphics processing units), which are not just for gaming but also fuel artificial intelligence (AI), machine learning, and cloud computing. The company has become a backbone for AI applications, from autonomous vehicles to generative AI tools like ChatGPT.

2025 Outlook

With AI adoption spreading across industries, demand for NVIDIA’s hardware and software solutions is expected to remain robust. Additionally, its new ventures into AI-specific chips and data center technology promise significant revenue growth.

Why It’s a Buy

Investors betting on the AI revolution can look to NVIDIA as a cornerstone holding. While its valuation may seem high, its growth trajectory and market dominance justify a long-term investment.

2. Tesla (TSLA): Beyond Electric Vehicles

Why Tesla?

Tesla is no longer just a car company—it’s a clean energy leader. With its solar products, energy storage solutions, and EV dominance, Tesla is poised to benefit from the global shift to renewable energy and sustainable transportation.

2025 Outlook

Tesla’s Gigafactories are ramping up production globally, and its innovations in battery technology could lower costs further. Additionally, Tesla’s foray into AI with autonomous driving systems adds another layer of growth potential.

Why It’s a Buy

Governments worldwide are pushing for stricter environmental regulations and promoting EV adoption, which plays directly into Tesla’s strengths. For investors, Tesla offers exposure to multiple high-growth sectors: EVs, renewable energy, and AI.

3. Amazon (AMZN): E-Commerce and Beyond

Why Amazon?

Amazon’s unmatched logistics network, e-commerce platform, and cloud computing services through AWS cement its position as a market leader. Its ventures into healthcare and AI further expand its opportunities.

2025 Outlook

- Continued growth in AWS revenue as businesses migrate to the cloud.

- E-commerce expansion driven by improved delivery services and global penetration.

- AI investments will enhance personalization and operational efficiency, boosting customer loyalty and profitability.

Why It’s a Buy

Amazon’s diversified business model and leadership in critical growth areas, including cloud computing and e-commerce, provide stability and growth potential. Its focus on innovation ensures relevance in evolving markets.

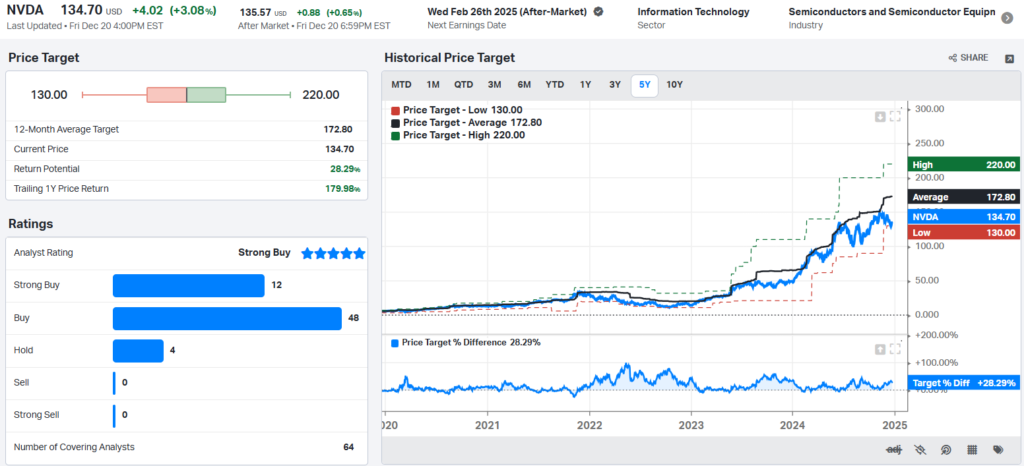

4. Johnson & Johnson (JNJ)

Why Johnson & Johnson?

A stalwart in healthcare, J&J benefits from a diversified portfolio of consumer health products, pharmaceuticals, and medical devices. The spin-off of its consumer health segment, Kenvue, allows the company to focus on high-margin, innovative healthcare solutions.

2025 Outlook

- Pharmaceuticals, especially oncology and immunology, are expected to drive growth.

- Medical devices will see a recovery as elective procedures return to pre-pandemic levels globally.

- Increased healthcare spending in aging populations worldwide supports long-term stability.

Why It’s a Buy

J&J offers a balance of growth and defensiveness, making it a core holding for conservative investors. Its strong cash flow and reliable dividend payments provide additional appeal.

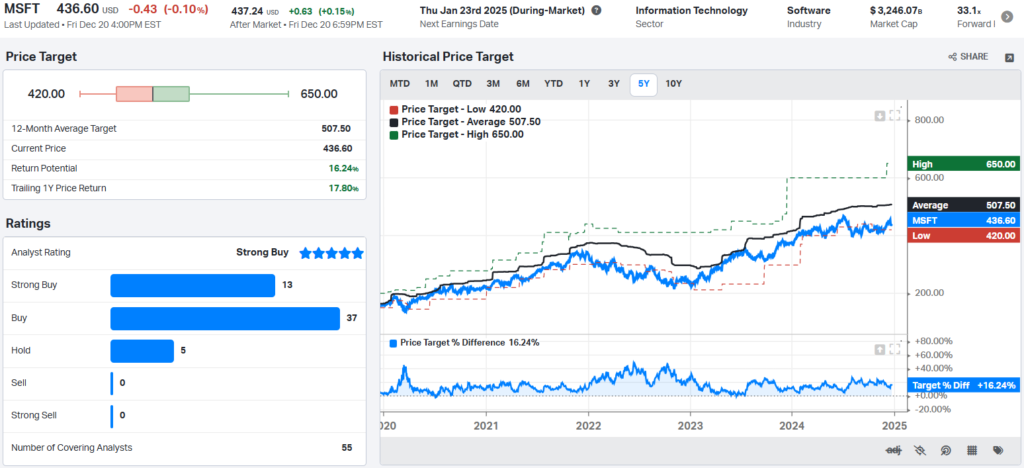

5. Microsoft (MSFT)

Why Microsoft?

Microsoft thrives on its robust ecosystem spanning enterprise software, cloud computing (Azure), and AI advancements. Its investment in OpenAI and integration of AI tools across platforms position it as a leader in the digital economy.

2025 Outlook

- AI applications in productivity tools, like Copilot in Microsoft 365, will enhance adoption rates.

- Continued Azure growth driven by the shift to cloud computing across industries.

- Diversified revenues from gaming, enterprise, and LinkedIn contribute to overall resilience.

Why It’s a Buy

Microsoft’s dominance in both legacy software and emerging AI technologies ensures sustainable growth. Its recurring revenue model and focus on innovation make it a dependable choice for investors.

Getting ready for 2025 portfolio’s reshifting

Selecting the best stocks for 2025 requires understanding both macroeconomic trends and individual company strengths. NVIDIA, Tesla, Amazon, Johnson & Johnson, and Microsoft represent a strategic mix of innovation and stability. These companies are positioned to benefit from transformative trends like AI, sustainability, and healthcare advancements.

For retail investors, the key to success lies in diversification, regular monitoring of market conditions, and a long-term perspective. With these stocks, you can align your portfolio with the future of business and technology while managing risks effectively.

Happy investing!